Industry News

2024 IECC Lighting Control Requirements

Lighting Controls Association (LCA) Education Director and LightNOW Founder, Craig DiLouie recently published an article, Deep Dive Into the Lighting Control Requirements of the 2024 IECC. The article provides a…

Agentic AI Moves Quickly Into Big Box Retail

“Agentic” AI in quickly gaining adoption in big box retail, including Walmart’s recent launch of its AI-powered shopping assistant, “Sparky.” Agentic AI refers to artificial intelligence systems that can act…

Ombra: A Self-Powered Smart Pergola

Ombra “room-as-an-appliance,” is a self-powered, and relocatable smart pergola developed by SolarYard (a LetRight Brand), in China. Ombra offers high-tech, off-grid garden structures, to transform the traditional concept of a…

pureLiFi’s KiteFin XE Delivers Greater Range & Gbps Capacity

pureLiFi, a global leader in LiFi technology, has announced the launch of Kitefin XE, its next-generation LiFi system designed to deliver highly secure wireless communications for defense, government, and enterprise…

US-China Trade Deal Is Only One Step In The Right Direction

Last week, the United States and China reached a new trade agreement framework following intense negotiations aimed at de-escalating the ongoing trade conflict between the two largest global economies.…

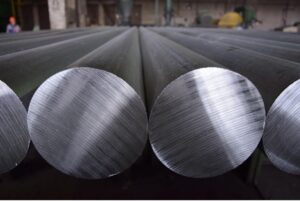

Fagerhult Introduces Recycled Aluminum For Sustainability

Fagerhult has taken an important step towards sustainability by announcing that its extruded aluminum profiles for several high-volume product lines will now consist of 75% recycled material. This change marks…

Clean Rooms And Amber Lighting

Amber LED light fixtures are used in cleanrooms to minimize the impact on photochemically sensitive materials and processes, such as photoresists used in semiconductor manufacturing. The 590nm amber light filters out shorter,…

Meta-Analyses Of Non-Visual Effects Of Light

A new study was published last month, Non-Image-Forming Effects of Daytime Electric Light Exposure in Humans: A Systematic Review and Meta-Analyses of Physiological, Cognitive, and Subjective Outcomes, in the IES…

Contractor Considerations For LED-To-LED Retrofits

A recent article, Guidelines for Converting LED to LED: What Turnkey Lighting Contractors Need to Know, by George McIntyre, addresses the emerging need for second-generation LED retrofits in commercial…

Why Smart, Wireless Lighting Is The Key To Elevated Design

By Chris Udall, senior product manager for commercial business, Lutron Electronics. The future of commercial lighting is wireless. As control systems evolve, smart wireless solutions are redefining what’s possible—building owners…