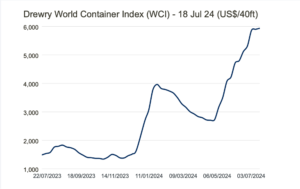

Since early May, global ocean freight container rates have been increasing steeply. The Drewry World Container Index (shown above) has increased nearly 400% since mid-December. The rapid increases exist from Shanghai to Los Angeles, Rotterdam, Genoa, and New York (see graph below). The causes for the current spike are numerous: Troubles in the Middle East, [...]

Lighting Industry

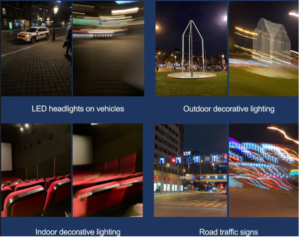

AMBI’S TOP FIVE LIGHTING TRENDS OF 2024

By AMBI As a marketing agency working with many global built environment brands, AMBI is sharing its key insights and trends in the lighting industry. Midway through 2024, numerous industry-leading lighting brands are working to craft their unique identities. In this environment, AMBI presents the key differentiators and points of discourse that have emerged through [...]

Construction + Economy, Lighting Industry

Japan’s Autonomous Freight Conveyor To Replace 25,000 Trucks

The Plan The Japanese government has a plan to create an autonomous freight hauling system connecting its major cities. The new system is expected to remove 25,000 freight trucks from the roads, and rely on conveyor belts or small, autonomous carts to move the freight. An initial link between Tokyo and Osaka is expected to [...]

Q2 2024 Acquisitions

Here is a quick summary of 11 acquisitions and one shut down, in the second quarter of 2024: Ameron Pole Products acquired by Arcosa, Inc. Details here LSI acquired EMI Industries. Details here. Armstrong (ceilings) acquired LightArt. Details here. ams OSRAM sold passive optical components assets to Focuslight. Details here. Illumination FL acquired Niteworx [...]

Education + Resources, Lighting Industry

10 Easy Tips For Better Lighting Product Spec Sheets

Having created many hundreds of lighting product spec sheets, here are my suggested tips for improving their clarity, design, and completeness: UNDERSTAND THE PURPOSE Always remember that the spec sheet has two purposes. The first is as a document to help sell the product, by highlighting up-front the key features, benefits, differentiation, and overall [...]

Construction + Economy, Lighting Industry

Key Trends In New Home Construction

Major homebuilding trends are being shaped by consumer preferences, sustainability concerns, and the latest technologies. Sustainability Builders are increasingly embracing green building certifications that demonstrate a commitment to green design & construction practices. Sustainable materials are becoming commonplace, such as bamboo flooring, recycled metal, and solar panels being integrated into new home designs. Energy efficiency, [...]

Education + Resources, Lighting Industry

tED magazine Replacing “lightED” with “electrifiED”

After 7 years of publishing the lightED website, NAED’s tED magazine will stop publishing lightED and start publishing a new website, electrifiED, focused on electrification and the associated supply chain. All past lightED articles and future articles about lighting will be relocated to tedmag.com. Starting Monday, July 1, electrifiED will be published at www.tedelectrified.com [...]

2024 Lighting Industry Event Updates

Lightovation Interior Designer Preview Day June 18th Lightovation is the largest residential lighting trade event in North America, held at the Dallas Market Center, June 19-22. A sneak peek Interior Designer Preview Day on June 18th will provide trade-focused presentations, tours and networking opportunities. RSVP here to reserve your spot and confirm your attendance. NAILD [...]

The Latest On Temporal Light Modulation (TLM) / Flicker

The American Lighting Association Engineering Committee recently received a presentation from the “Flicker Queen,” researcher Naomi Miller, at Pacific Northwest National Laboratory (PNNL). Ms. Miller provided a summary of her latest research at PNNL on temporal light modulation (TLM), more commonly known as flicker. She and PNNL colleagues completed a human subjects study on the [...]

Legislation + Regulation, Lighting Industry

USTR Releases Four-year Review of Section 301 Tariffs

By Michael Weems, VP of Public Policy, American Lighting Association What You Need to Know: Increased prices, as a result of the Section 301 tariffs on product coming from China, are here to stay and new tariffs are on the way. The Office of the United States Trade Representative (USTR) recently released the long-awaited [...]