On July 2, 2025, The White House announced a new tariff agreement with Vietnam, representing the administration’s first trade deal in Asia outside of China, and signaling a notable shift in US trade policy in the region. The agreement sets a 20% tariff rate on certain goods. The primary goal of this deal is [...]

Construction + Economy

US-China Trade Deal Is Only One Step In The Right Direction

Last week, the United States and China reached a new trade agreement framework following intense negotiations aimed at de-escalating the ongoing trade conflict between the two largest global economies. This development, announced Wednesday, after talks in London, built on a prior consensus from Geneva in May 2025. The deal represents a partial rollback of [...]

Construction + Economy, Lighting Industry

How US-China Tariff Reprieve Affects The Lighting Industry

The recent 90-day tariff reprieve between the U.S. and China, announced last week, marks a significant but temporary easing of trade tensions that have deeply affected the lighting industry and many other industries reliant on Chinese imports. The agreement reduces tariffs on imports from China from an unprecedented 145% to 30%, and on U.S. goods [...]

Construction + Economy, Lighting Industry

How Tariffs & Supply Chain Chaos Are Shaping The M&A Market

By Derek Bobbitt and Geoff Ling, Merrimack Group The first 100 days of the new U.S. administration have been tumultuous to say the least. The tariff war has caused major disruption to supply chains, caused significant stock market volatility, and stoked fears of inflation and recession. For lighting business owners, this environment has introduced a [...]

Construction + Economy, Lighting Industry

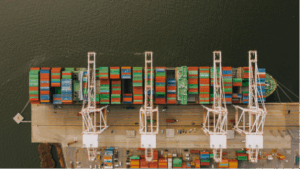

Shipments From China To US Manufacturers & Retailers Stopped

President Trump’s unprecedented tariffs on Chinese imports, which have triggered a dramatic drop in shipments from China to the United States, cast a shadow of uncertainty over the U.S. economy. President Trump, fulfilling campaign promises, has radically altered decades of American trade policy by imposing broad and unpredictable tariffs. As of early April 2025, a [...]

Home Remodeling Predicted to Grow From Tariffs

The landscape of the U.S. home remodeling sector is evolving in 2025, due to the interplay between tariff pressures and a potential rebound in renovation activity. During the pandemic, there was a surge in home improvement projects as people spent more time at home, and spent less money on going out to eat and travel. [...]

Construction + Economy, Legislation + Regulation

Judge Orders Administration To Restore IIJA & IRA Funding

A federal judge has ordered the Trump administration to immediately reinstate funding previously awarded under the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA), after President Trump froze these disbursements on his first day back in office. The ruling, delivered by Judge Mary McElroy of the U.S. District Court for [...]

Home Depot & Lowe’s Both See Strong Q4 Sales

Home Depot Home Depot’s Q4 2024 financial report reveals promising growth, signaling a potential loosening of previously tight home improvement spending. Sales for the quarter reached $39.7 billion, a 14.1% increase compared to Q4 2023, with comparable sales up by 0.8%, ending eight consecutive quarters of decline. In the U.S., comparable sales rose by [...]

2025-2026 Construction Forecast

Here is a quick summary of the construction forecast for 2025-2026, highlighting key trends and developments in various sectors of the construction industry. Non-Residential Construction Non-residential construction is expected to grow slowly through 2025, with no significant decline anticipated. However, certain segments within the private non-residential sector may experience downturns, while data centers and semiconductor [...]

Construction + Economy, Lighting Industry

Data Center Boom Impacting The Lighting Industry

The data center sector has exploded into a major force in construction, fueled by the increasing demands of artificial intelligence. This surge is significantly boosting nonresidential construction planning, with projections indicating it could add substantially to U.S. economic growth in the coming years. This data center construction boom hasn’t gone unnoticed in the lighting [...]