Fagerhult, a Swedish lighting company, has introduced an innovative AI-powered lens selection guide designed to simplify roadway lighting design. This tool eases the process of selecting optimal optics for road and street lighting projects, addressing the complex challenges faced by lighting designers. The AI lens guide streamlines the selection of appropriate lenses by considering [...]

David Shiller

Controls, Products + Technology

Will Ultrasonic ToF Sensors Replace PIR & Microwave Sensors?

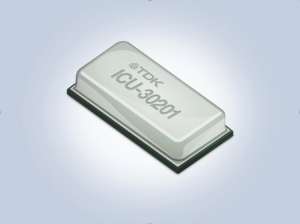

TDK Corporation has launched full-scale production of its InvenSense SmartSonic ICU-30201 ultrasonic time-of-flight (ToF) sensor, in January 2025. This sensor enhances contextual awareness for various applications requiring accurate presence, proximity, and distance measurements, including robotics, drones, alarm devices, door locks, camera devices, and other smart building systems such as lighting. Its enhanced maximum range, [...]

Construction + Economy, Legislation + Regulation

What Trump Tariff Policy Might Look Like

The new presidential administration has brought Trump’s proposed tariff policies into sharp focus. Trump’s campaign promised broad tariffs on imports from various countries, and now global attention is turning to how he might implement these policies. Potential Tariff Strategies Trump’s tariff agenda appears to be more expansive than his first term, with plans for: A [...]

Product Monday: Aira By Litecontrol

Aira is an open-center linear pendant from Lite control, a Current brand. Aira provides: Refined aesthetic with the ability to see through the center of the luminaire provides scale without weight overhead. Semi-Direct (25/75) distribution with extra wide direct and low peak indirect for wide fixture spacing and lighting power density maximization. Integral driver, [...]

Codes + Standards, Legislation + Regulation

15 State AGs & NAHB File Suit To Stop Energy Code Changes

The National Association of Home Builders (NAHB) and 15 state attorneys general have filed a lawsuit against the U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of Agriculture (USDA) over new energy efficiency standards for certain single-family homes and multifamily housing programs. The lawsuit, filed on January 2, 2025, in the [...]

2 New CCTs Published In ANSI C78.377-2024

ANSI recently published ANSI C78.377-2024: Electric Lamps – Specifications for the Chromaticity of Solid-State Lighting (SSL) Products. It covers the range of chromaticities recommended for general solid-state lighting (SSL) products so that the white light chromaticities of the products can be communicated to both commercial and residential consumers. The color appearance of SSL sources is [...]

Elevated Hospitality: Bulgari Hotel Roma

Here is my article in the December 2024 issue of LD+A: Nestled in the heart of Rome, the Bulgari Hotel Roma stands as a tribute to the illustrious legacy of Sotirio Bulgari, the legendary jeweler famed for adorning the world’s stars of stage and screen. As the ninth addition to the Bulgari Hotels & Resorts [...]

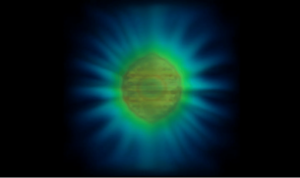

Researchers Determine “Shape” Of A Single Photon

Physicists at the University of Birmingham have created the first direct visualization of a photon’s shape. This groundbreaking achievement provides new insights into the fundamental nature of light and its interactions with matter. Photons, the particles of light, are impossible to photograph directly as they don’t interact with each other. However, researchers have now [...]

LED + SSL, Products + Technology

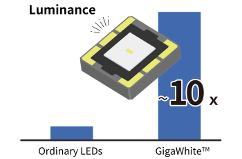

Nichia Releases GigaWhite White Laser SMD

Nichia has launched GigaWhite, an ultra-bright SMD white laser diode surface mount device (SMD) created by combining a blue laser diode (LD) and phosphor. It was developed for automotive headlights, specialty lighting, and industrial lighting. Nichia’s technology has achieved uniform light with less color irregularity. Taking advantage of the characteristics of its ultra-high luminance, [...]

Energy + Environment, Legislation + Regulation

Brazil Eliminated Daylight Savings Time; Now Reconsidering

Brazil is reconsidering its decision to eliminate daylight saving time (DST) due to climate change-related energy challenges. In 2019, former President Jair Bolsonaro ended the practice, promising a “permanent” solution to clock confusion. However, recent energy emergencies and the prospect of more to come have prompted a reevaluation of this decision. The elimination of [...]