The Smart Surfaces Coalition, in partnership with the Sabin Center for Climate Change Law, has launched an updated Smart Surfaces Policy Tracker, a comprehensive tool designed to help U.S. cities and states track, compare, and implement policies that address extreme urban heat and flooding through innovative surface design strategies. The tool compiles over 1,935 policy [...]

Legislation + Regulation

Legislation + Regulation, Sustainability

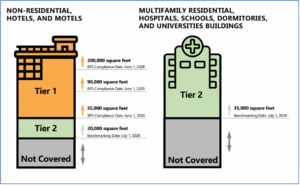

Oregon Launches Its Building Performance Standards Program

The Oregon Department of Energy (ODOE) has launched a new Building Performance Standard (BPS) program aimed at improving energy efficiency in existing large commercial buildings across the state. This initiative, established through the passage of House Bill 3409 by the Oregon Legislature in 2023, marks Oregon as the fourth state in the nation to [...]

Construction + Economy, Legislation + Regulation

Judge Orders Administration To Restore IIJA & IRA Funding

A federal judge has ordered the Trump administration to immediately reinstate funding previously awarded under the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA), after President Trump froze these disbursements on his first day back in office. The ruling, delivered by Judge Mary McElroy of the U.S. District Court for [...]

US DOE Finalized GSL Test Procedure

The U.S. Department of Energy (DOE) has finalized and published clarifications to the test procedures for General Service Lamps (GSLs), including changes to how tunable white lamps are tested and expanded definitions for ballasts. The effective date of this rule was initially set for February 18, 2025, but was later temporarily delayed to March 21, 2025. [...]

Legislation + Regulation, Lighting Industry

The Trade War Is On

The American Lighting Association (ALA) sent out a good summary of last week’s tariff escalations by the Trump Administration. President Trump is invoking his authority under the International Emergency Economic Powers Act of 1977 (IEEPA) to, as the White House puts it, “address the national emergency posed by the large and persistent trade deficit that [...]

DOE Pauses Implementation of GSL Efficiency Standards

The U.S. Department of Energy (DOE) announced on February 14th that it would postpone the implementation of several appliance energy efficiency standards that the Biden administration had finalized. This pause includes General Service Lamps (GSL), which include a large variety of screw-based lamps and some linear tube lamps. The Energy Secretary, Chris Wright, claimed [...]

Construction + Economy, Legislation + Regulation

Trump EO Freezes Billions Of Dollars Of IIJA & IRA Projects

On inauguration day, President Trump issued an executive order to halt disbursements of funding from the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA), causing uncertainty for numerous climate and infrastructure projects. This “Unleashing American Energy” order directs federal agencies to pause and review funding processes for these acts. Scope and [...]

No Filing Of Beneficial Ownership Info Required To FinCEN

For weeks, court cases across the United States have resulted in several reversals of the Financial Crimes Enforcement Network (FinCEN) requirement for Reporting Businesses to file Beneficial Ownership Information (BOI) to comply with the Corporate Transparency Act (CTA). In the latest reversal, on January 24, 2025, FinCEN issued new guidance on the CTA. The guidance [...]

Construction + Economy, Legislation + Regulation

What Trump Tariff Policy Might Look Like

The new presidential administration has brought Trump’s proposed tariff policies into sharp focus. Trump’s campaign promised broad tariffs on imports from various countries, and now global attention is turning to how he might implement these policies. Potential Tariff Strategies Trump’s tariff agenda appears to be more expansive than his first term, with plans for: A [...]

Codes + Standards, Legislation + Regulation

15 State AGs & NAHB File Suit To Stop Energy Code Changes

The National Association of Home Builders (NAHB) and 15 state attorneys general have filed a lawsuit against the U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of Agriculture (USDA) over new energy efficiency standards for certain single-family homes and multifamily housing programs. The lawsuit, filed on January 2, 2025, in the [...]