In the second installment in our Fall Philanthropy Series, we explore the significant impact of corporate philanthropy and fundraising in the lighting industry, showcasing remarkable results achieved when like-minded individuals unite for a common cause. The H Foundation – Based in LaGrange, Illinois, The H Foundation was established in 2001 by Hortons Home Lighting [...]

Lighting Industry

Construction + Economy, Lighting Industry

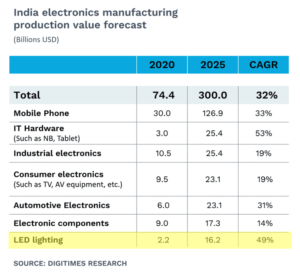

India’s Growth In LED Lighting Manufacturing

I’ve written previous articles about the gradual shift in US imports away from China toward Mexico, India, Southeast Asia and Eastern Europe, here and here. The above chart is courtesy of DigiTimes Research. It projects India’s production value of LED lighting to rise from $2.2 Billion USD in 2020 to $16.2 Billion in 2025. That’s [...]

Construction + Economy, Lighting Industry

Taiwanese Business Interest In Mainland China Decreasing

For a variety of reasons, Taiwanese businesses are reducing their investments in mainland China. One reason is the difficulties China faced during the COVID-19 pandemic, and the extreme challenges that were specific to China, including their unprecedented extended shutdowns of large commercial cities such as Shanghai, among others. Many larger, Taiwanese companies have been relocating [...]

Amazon Eliminating Private Brands For Lighting

Amazon.com announced in August that it is eliminating 27 of its 30 private label brands across home goods and apparel. Amazon Basics and Amazon Essentials will continue with opening price point apparel. The two Amazon private brands that offered residential lighting were Stone & Beam and Rivet. One published report said both of these private [...]

Lighting Industry, Products + Technology

RGBW Product Line Acquisition Opportunity

An RGBW product line with brand name recognition and consisting of a family of LED RGBW Downlight, Flood, and Facade products, and related controls is being offered for acquisition. The technology delivers fine-tuned pastel colors and saturated hues without sacrificing illumination brightness. This RGBW business unit was acquired in Q1, 2022 by a custom linear lighting company. Subsequently, with [...]

Construction + Economy, Lighting Industry

More Industries Adopting “China+1” Risk Management Strategy

I’ve previously written several posts on the reduction of trade between the US and China. This is largely caused by the escalating and evolving trade war. Companies in a growing number of industries are managing Chinese sourcing risk by adopting the stragegy of diversifying their supply chain to include China plus another source outside [...]

Construction + Economy, Lighting Industry

Freight Costs Are Rising Again

The economic rebound from the pandemic created a chaotic freight nightmare. Those days are behind us, but new factors are beginning to drive freight costs back up again, both for bringing goods in from Asia to the US, as well as sending freight within the US. Here are some causes: Labor – The feared [...]

Autani Merges With LiteTrace

Today, Autani, a leading provider of advanced building automation and energy management solutions, and LiteTrace, a pioneer in Bluetooth® lighting control solutions, announced their merger to create a global leader in smart commercial building technologies and energy optimization. The merger combines Autani’s award-winning building automation platform and LiteTrace’s innovative Keilton brand of Bluetooth mesh [...]

Education + Resources, Lighting Industry

New Lighting History Blog

Self-professed lighting nerd and historian Frank Grobmeier recently launched an illuminating look back at the lighting industry’s historical and little-known facts with his blog Radiant History (www.radianthistory.com). The blog unveils tales of luminosity and delves into the evolution of light throughout the ages. From candles and oil lamps to the birth of solid-state luminaries, Radiant [...]

Construction + Economy, Lighting Industry

A Year Of Lighting Manufacturer Shut Downs

2023 has already seen quite a few lighting manufacturer shut downs. I’m not talking about Chapter 11 restructurings nor acquisitions. Here are seven lighting manufacturers that shuttered operations so far in 2023: Universal-Douglas – Shut down March 22nd. More details here. Pathway Lighting – Shut down June 9th. Asset auction closes September 13th. More [...]