The American Lighting Association (ALA) sent out a good summary of last week’s tariff escalations by the Trump Administration. President Trump is invoking his authority under the International Emergency Economic Powers Act of 1977 (IEEPA) to, as the White House puts it, “address the national emergency posed by the large and persistent trade deficit that [...]

Lighting Industry

Terry McGowan Retires & Mary Beth Gotti Assumes ALA Role

Terry McGowan announced that he will be retiring as the Director of Engineering at the American Lighting Association (ALA). McGowan has had a distinguished 60-year career in the lighting industry, marked by innovation, education, and leadership. He began his career at GE Lighting, where he worked for 38 years in roles such as lighting application [...]

NEMA Lighting Control User Interface Technical Report

The National Electrical Manufacturers Association (NEMA) has published C137 TR 1-2024, Lighting Control User Interface Technical Report. It is a technical report, not a formal standard. This technical report recommends user interface elements for lighting controls utilized by end-users and occupants. It is applicable to hardware controls, software applications, personal control apps, displays, and [...]

Construction + Economy, Lighting Industry

Data Center Boom Impacting The Lighting Industry

The data center sector has exploded into a major force in construction, fueled by the increasing demands of artificial intelligence. This surge is significantly boosting nonresidential construction planning, with projections indicating it could add substantially to U.S. economic growth in the coming years. This data center construction boom hasn’t gone unnoticed in the lighting [...]

Energy + Environment, Lighting Industry

ESCOs Evolve: System Upgrades, Resiliency, & Electrification

The core mission of achieving energy savings remains central to the relationship between institutional and commercial facilities and Energy Service Companies (ESCOs). However, facilities are constantly evolving due to various factors like maintenance issues, climate change, and occupancy shifts. While ESCOs have existed for around 40 years, the industry continues to adapt to meet these [...]

Good Earth Lighting Co-Founder Marvin Feig Passes Away

Good Earth Lighting is saddened to announce the passing of the company’s Founder and former President, Marvin Feig, on February 19, 2025 at the age of 78. Marvin founded Good Earth Lighting in1992 with Co-Founder and Vice President of Research & Development, Alex Kowalenko. Good Earth Lighting’s mission at its founding according to Marvin [...]

Q4 2024 Acquisitions

Here is a quick summary of 6 acquisitions and one divestment, in the fourth quarter of 2024: PE Firm acquired Techlight. Details here. Acuity Brands acquired QSC, LLC, an audiovisual solution manufacturer. Details here. Beghelli was acquired by GEWISS, both Italian companies. Details here. Siemens acquires Toggled as part of Altair Engineering acquisition. Details here. [...]

Construction + Economy, Lighting Industry

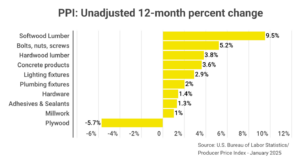

Lighting & Other Building Supply Commodity Prices Rise

The Producer Price Index (PPI) report from the U.S. Bureau of Labor Statistics indicates that while plywood prices have fallen, most other key hardware and building supply commodities have increased in price. Light Fixtures: The price of light fixtures increased 2.9% in January 2025 compared to January 2024. From December 2024 to January 2025, light [...]

11 Utilities Report Commercial Lighting Rebates’ Future

DNV, a leading utility evaluation and verification contracting firm, has published the LightingPLUS Market Characterization report. This is a joint study by 11 program administrators (PAs) from the U.S. and Canada, investigates the evolving commercial and industrial (C&I) lighting market. The study focuses on quantifying the remaining opportunities for legacy lighting replacements with LEDs [...]

Lighting Industry, Women In Lighting

Resimercial Lighting “Made In USA Directory” Launched By LNN

At a time when many lighting trade publications are closing up shop, it was great to learn of a new lighting publication’s launch, Lighting News Now (LNN), led by industry veteran, Linda Longo, as Editor-in-Chief. The new online publication reports on the decorative residential lighting industry. Given all of the talk and uncertainty around tariffs, [...]