While basic ERP and CRM systems have been around a long time, there are more and more software programs designed specifically for the lighting and electrical markets. Here’s a look at some that I’ve been hearing about and some that I’ve researched online. This is not intended as endorsements for any of them, but rather [...]

Lighting Industry

Codes + Standards, Lighting Industry

Updates Coming To DLC SSL & Hort Technical Requirements

The Design Lights Consortium (DLC) has announced changes are coming to the technical requirements for two of its programs. DLC technical requirements are mandated by up to 80% of prescriptive commercial lighting rebate programs, making them critical for manufacturer products to qualify for most rebates. SSL V5.2 & V6.0 The DLC has announced two phases [...]

Get Ready For LED Socket Saturation

Residential Game Over Socket saturation for residential lighting is guaranteed. The DOE already has a 45 lpW requirement currently in effect for General Service Lamps (GSL), which has effectively banned most halogen. DOE also has finalized standards that will increase GSL efficacies up to roughly 120 lpW (varies slightly based on lumen output), over the [...]

How Facility Management Is Evolving

The US facility management industry was estimated at $2.1 Trillion in 2023, and is projected to reach $3.5 Trillion by 2030. The industry is changing fast and is faced with four large challenges: sustainability & resilience, smart building technologies, advanced materials, construction methods, & equipment, and addressing talent shortages. Reducing the environmental impact of facilities [...]

NEMRA Manufacturer Of The Future Report Released

Last month, the National Electrical Manufacturers Representative Association (NEMRA) published their Manufacturer of the Future Report. Channel Marketing Group conducted research, interviewing over 30 manufacturers for their input into major trends impacting manufacturers. Four primary areas of inquiry were: Consolidation throughout the ED channel and its impacts (distributor, rep, & manufacturer M&A) Increasing operational efficiency [...]

US Military Needs $50 Billion Of Building Maintenance

The Congressional Budget Office has issued a report that analyzed the condition of more than 100,000 military buildings, using 2020 data. The buildings are on Air Force, Army, Marine Corps, and Navy bases in the US, including territories. The report finds that total deferred maintenance was $50 billion on the bases. 70% is needed [...]

Two New IES Standards For BIM And Lighting Maintenance

The IES has published two new standards: ANSI/IES TM-32-24 Lighting Practice: Lighting Parameters for Building Information Modeling This is the IES-recommended standardization of parameters attached to objects, object libraries, or parametric features that represent luminaires for use in many different types of BIM software. Now available in an IES Lighting Library subscription or at the IES [...]

Small Market Research Projects For Better Business Decisions

Unsure about launching a new product or service or debating about entering a new vertical? There are so many questions to ask and answer. What are the necessary certifications? Input voltages? Sales channels? Market size and growth rate (CAGR)? What are the various categories of applications or product types for the new market sector? [...]

Codes + Standards, Lighting Industry

Four Paths To UL Safety Listing

By Patrick Treadway, President, Syndesis LLC “UL is a government agency” the supplier was trying to explain to me over the phone, “we don’t want to break a law,” he concluded. If anyone has been engaged in product development using offshore manufacturing long enough, he or she has likely heard similar remarks. Another comment heard [...]

Construction + Economy, Lighting Industry

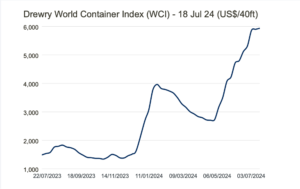

Ocean Freight Rates Spiking Again

Since early May, global ocean freight container rates have been increasing steeply. The Drewry World Container Index (shown above) has increased nearly 400% since mid-December. The rapid increases exist from Shanghai to Los Angeles, Rotterdam, Genoa, and New York (see graph below). The causes for the current spike are numerous: Troubles in the Middle East, [...]