At LightFair, I was part of a panel presenting the impacts of electrification on the lighting industry. This article is Part 6 of the series. In Part 3 of this series, the drivers of deeper energy efficiency retrofits were discussed, including: Rapid rises in electric utility rates that will likely continue for some time. [...]

Construction + Economy

Construction + Economy, Energy + Environment

Electrification Impacts On Lighting, Part 5: DC Fixtures

At LightFair, I was part of a panel presenting the impacts of electrification on the lighting industry. This article is Part 5 of the series. Electrification of building heat, hot water, cooking, as well as the transportation sector will create tremendous stresses on the electrical grid and utilities. This is already beginning to happen [...]

Construction + Economy, Energy + Environment

Electrification Impacts On Lighting, Part 4: Material Shortages

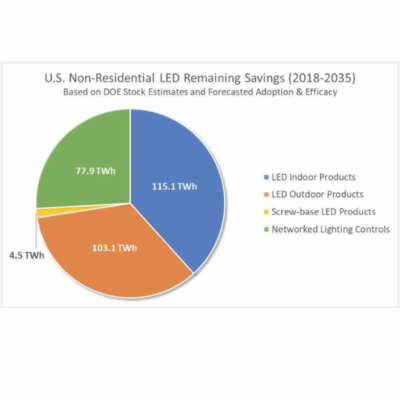

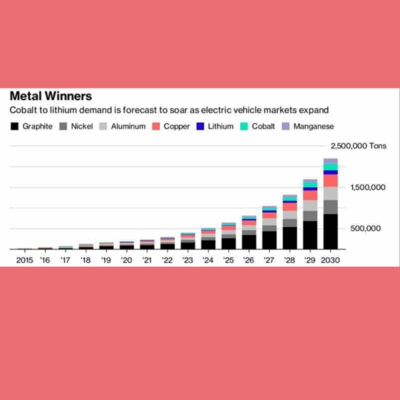

At LightFair, I was part of a panel presenting the impacts of electrification on the lighting industry. This article is Part 4 of the series. Two of the biggest consequences of electrification will be the mass adoption of electric vehicles as well as the rapid increase in renewable energy generation. Both of these will create [...]

Construction + Economy, Legislation + Regulation

Electrification Impacts On Lighting, Part 1: Building & Energy Codes

At LightFair, last week, I was part of a panel presenting the impacts of electrification on the lighting industry. I had the pleasure of co-presenting with Chris Brown and Peter Brown, two prominent thought leaders in the lighting industry. I’m going to share some of the key impacts on lighting in a series of [...]

Construction + Economy, Lighting Industry

NRF’s State Of Retail & The Consumer

The National Retail Federation (NRF) released it’s annual State of Retail & the Consumer forecast. Here are the highlights: The retail sector is expected to grow 4-6% in 2023, to $5.13-$5.23 Trillion. 2022 saw 7% growth over 2021. 2023’s forecast is higher than pre-pandemic growth of 3.6% E-commerce sales expected to rise 10-12% in 2023, [...]

Construction + Economy, Lighting Industry

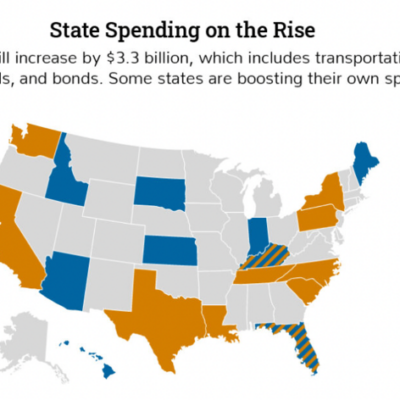

State Spending On Highway, Street, & Bridge Construction Up 10% In FY23

States are increasing their spending on highways, streets, and bridge construction by 10% in fiscal year 2023. Four out of five states expect to increase this type of infrastructure spending in FY2023 over the previous year. Almost 75% of the increase is due to increased federal reimbursements to states. This includes early spending on IIJA [...]

Construction + Economy, Lighting Industry

U.S. Evolving And Escalating Trade War With China

The United States government and some allies are evolving and escalating the trade war with China. During the Trump administration, the trade war was characterized by increasing trade tariffs, most of which are still in place today, during the Biden administration. Now the trade war is escalating in new directions. FRIENDSHORING: In the past month, [...]

Construction + Economy, Lighting Industry

Freight Rates Expected To Drop In 2023

Sea, air, and trucking models all predict dropping freight volumes in 2023, which would lead to lower shipping costs and could make some goods more affordable. This is according to a trio of forecasts released last month. Those three forecasts found a “severe rate of contraction” in transportation prices measured in November, according to the Logistics Managers’ [...]

Construction + Economy, Lighting Industry

What You Should Know About Quiet Hiring

Both business owners and employees should be aware of the new HR trend called “quiet hiring.” Quiet hiring is when an organization acquires new skills without hiring new full-time employees. Sometimes, it means hiring short-term contractors (external quiet hiring). Other times, it means encouraging current employees to move into new or additional roles within the organization [...]

2023 Economic Forecast

Very happy new year, and thank you for being a LightNOW reader. To create a summary of the 2023 economic outlook, I’ve reviewed several forecasts, both from inside the electrical industry and beyond. Here is my summary: Nonresidential Construction: AIA’s consensus forecast for the 2023 nonresidential construction market calls for a 6% increase. 7% increase [...]