I’ve previously written several posts on the reduction of trade between the US and China. This is largely caused by the escalating and evolving trade war. Companies in a growing number of industries are managing Chinese sourcing risk by adopting the stragegy of diversifying their supply chain to include China plus another source outside [...]

Construction + Economy

Construction + Economy, Lighting Industry

Freight Costs Are Rising Again

The economic rebound from the pandemic created a chaotic freight nightmare. Those days are behind us, but new factors are beginning to drive freight costs back up again, both for bringing goods in from Asia to the US, as well as sending freight within the US. Here are some causes: Labor – The feared [...]

Construction + Economy, Lighting Industry

A Year Of Lighting Manufacturer Shut Downs

2023 has already seen quite a few lighting manufacturer shut downs. I’m not talking about Chapter 11 restructurings nor acquisitions. Here are seven lighting manufacturers that shuttered operations so far in 2023: Universal-Douglas – Shut down March 22nd. More details here. Pathway Lighting – Shut down June 9th. Asset auction closes September 13th. More [...]

Mexico Surpasses China As Top US Trade Partner

In mid-July, Mexico passed China to become the U.S.’s largest trading partner. Experts say Mexico’s gains are due to the U.S. strategy of gradual economic decoupling from China. This trend has is also named “Friendshoring,” where trade moves from China to countries like Mexico, India, Vietnam, and other trade partners with less contentious relationships [...]

U.S. Economy Defying Recession Predictions

Despite many predictions of a recession this Summer, the U.S. economy continues to chug along strongly, including consumer spending on luxury items, which typically see reduced demand in a faltering economy. Plastic surgery, motorcycle sales, cruise sales, and expensive concert ticket sales are four examples that are all booming this Summer. Consumer spending is especially [...]

Construction + Economy, Research

How Will A Gallium Shortage Affect LED Costs?

I’ve previously written about China’s gallium export ban not impacting current global gallium supplies here. I’ve also written about the recent 2023 DOE Critical Materials Assessment, here. A deeper look at the Critical Materials Assessment shows the LED industry might be in for a rough ride. The majority of white light LEDs are made [...]

Construction + Economy, Lighting Industry

India’s Population & Economy Rise As Global Leaders

In April 2023, the UN announced that India’s population had surpassed China’s, to become the largest in the world. India’s economy is also on a trajectory to surpass the U.S. in the next 50 years. The U.S. is currently the largest global economy with China in the #2 spot. Over the 15 years prior [...]

Construction + Economy, Energy + Environment

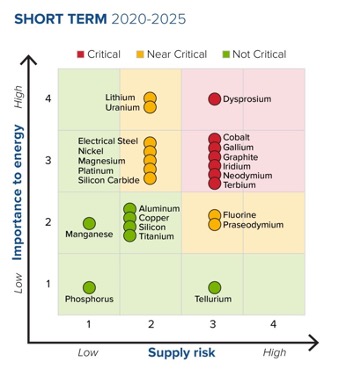

US DOE Assesses Critical Materials For Energy

The US Department of Energy (DOE) has completed an assessment of critical materials for energy. The Energy Act of 2020 defines a “critical material” as: Any non-fuel mineral, element, substance, or material that the Secretary of Energy determines: (i) has a high risk of supply chain disruption; and (ii) serves an essential function in one [...]

Construction + Economy, Lighting Industry

20% Increase In Non-Residential Construction Forecasted By AIA Panel

The American Institute of Architect’s (AIA) Consensus Construction Forecast panel has projected nonresidential building spending in late 2023 and beyond and predicts that spending on buildings will increase by 20% this year. This would be the highest rate since the years leading up to the Great Recession. The panel found an extremely strong start in [...]

Construction + Economy, Lighting Industry

GaN Device Makers Confirm Chinese Gallium Restrictions Won’t Disrupt Supply

In April, 2023, I wrote about the evolving and escalating trade war between the U.S. & China. One of the developments was the U.S. and some of its allies banning the sale of advanced AI computer chips to China. On July 3rd, China retaliated with an announcement that it would impose export restrictions on [...]