The other day, I heard a repeat of an old Planet Money radio show episode on NPR about the history of light. Rather than just focus on the changes in technology over thousands of years, it really focused on the economic history of light. The story interviews a Yale economics professor who studied how [...]

Construction + Economy

Construction + Economy, Lighting Industry

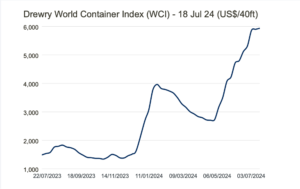

Ocean Freight Rates Spiking Again

Since early May, global ocean freight container rates have been increasing steeply. The Drewry World Container Index (shown above) has increased nearly 400% since mid-December. The rapid increases exist from Shanghai to Los Angeles, Rotterdam, Genoa, and New York (see graph below). The causes for the current spike are numerous: Troubles in the Middle East, [...]

Construction + Economy, Lighting Industry

Japan’s Autonomous Freight Conveyor To Replace 25,000 Trucks

The Plan The Japanese government has a plan to create an autonomous freight hauling system connecting its major cities. The new system is expected to remove 25,000 freight trucks from the roads, and rely on conveyor belts or small, autonomous carts to move the freight. An initial link between Tokyo and Osaka is expected to [...]

Construction + Economy, Lighting Industry

Key Trends In New Home Construction

Major homebuilding trends are being shaped by consumer preferences, sustainability concerns, and the latest technologies. Sustainability Builders are increasingly embracing green building certifications that demonstrate a commitment to green design & construction practices. Sustainable materials are becoming commonplace, such as bamboo flooring, recycled metal, and solar panels being integrated into new home designs. Energy efficiency, [...]

Construction + Economy, Lighting Industry

Trouble Arrives In The Multifamily Real Estate Market

In late January, LightNOW posted about signs of trouble ahead for the Multifamily real estate market. There are now indications that trouble has arrived. Apartment loans at least 30 days past due or in non-accrual have jumped 81%. Banks are increasingly taking losses on apartment loans. This will likely lead to distressed selling, as well [...]

Construction + Economy, Lighting Industry

Delivery Of New Freighters Could Reduce Shipping Costs & Disruptions

I’ve recently written about how dual crises in the Suez Canal / Red Sea and the Panama Canal have created chaos, rising cargo prices, and delaying supply chains. More on these dual canal crises can be found here. Now there is some good news for global shipping. As the pandemic eased, global shipping demand outstripped [...]

Construction + Economy, Lighting Industry

Two Most Important Global Shipping Canals Are In Crisis, Stressing Supply Chains…Again

Simultaneous and separate crises are occurring at the Panama Canal and the Suez Canal simultaneously. These are the two most important global shipping canals. The Panama Canal is suffering from a drought in the lake that supplies its water. The drought is likely caused and made more severe by climate change. The Suez Canal [...]

Is The Multifamily Real Estate Market In Trouble?

It’s widely known that the office real estate market has been severely hurt by the COVID-19 pandemic, and in fact, continues to get worse even after the pandemic is over. This is largely due to the persistence of work-from-home for a significant portion of the workforce. The national office vacancy rate rose to a record-breaking 19.6% in [...]

Construction + Economy, Lighting Industry

Shipping Container Rates Spike Due To Red Sea Attacks

Container shipping rates for important global trade routes have spiked this week due to the combination of Iran-backed Houthi forces in Yemen, and the recent air strikes against Houthi bases, by the US and UK. There are now shipping industry fears of a prolonged disruption to Red Sea trade routes, one of the busiest [...]

Construction + Economy, Lighting Industry

China’s Economy Forecasted To Slow Down in 2024 & 2025

The World Bank forecasted that 5.2% annual growth for China in 2023 will slow to 4.5% in 2024, and down to 4.3% in 2025. China’s growth has fluctuated dramatically in recent years, ranged from 2.2% in 2020 to 8.4% in 2021 and 3% in 2022. China’s economy is feeling the drag following severe pandemic [...]