On inauguration day, President Trump issued an executive order to halt disbursements of funding from the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA), causing uncertainty for numerous climate and infrastructure projects. This “Unleashing American Energy” order directs federal agencies to pause and review funding processes for these acts. Scope and [...]

Construction + Economy

Construction + Economy, Lighting Industry

10 Trends In Digital Marketing & E-commerce

The following are ten key digital marketing trends expected to shape both digital marketing and e-commerce, in 2025. 6 of the 10 involve AI! Social Commerce: Social platforms are projected to contribute over 10% of website commerce by 2025, up from the current 7%. This highlights the growing influence of social media on purchasing decisions. [...]

Construction + Economy, Lighting Industry

2nd East & Gulf Coast Dockworker Strike Averted In January

A potential strike by dockworkers at East and Gulf Coast ports in the United States has been averted following a tentative agreement reached between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) in mid-January. This new six-year contract resolves a labor dispute that had threatened to disrupt shipments for the second [...]

Construction + Economy, Legislation + Regulation

What Trump Tariff Policy Might Look Like

The new presidential administration has brought Trump’s proposed tariff policies into sharp focus. Trump’s campaign promised broad tariffs on imports from various countries, and now global attention is turning to how he might implement these policies. Potential Tariff Strategies Trump’s tariff agenda appears to be more expansive than his first term, with plans for: A [...]

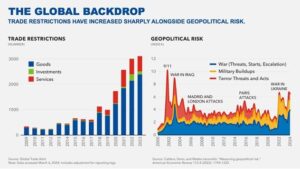

The New Neutrals Are The Hedge Economies

The global economy has entered a new era of geopolitical fragmentation, driven by a series of shocks over the past eight years, including trade conflicts, the COVID-19 pandemic, and ongoing wars in Ukraine and the Middle East. This fragmentation is reshaping investment and trade flows, leading to a reorganization of the global economic landscape. [...]

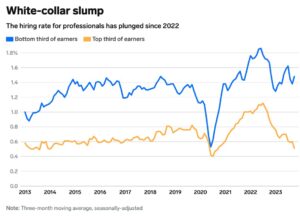

The White-Collar Recession

A significant trend in the job market in 2024 is characterized by a “white-collar recession,” contrasting with a robust blue-collar sector. Major firms across various industries have been laying off thousands of white-collar employees, while blue-collar jobs remain in high demand. In the consulting industry, giants like Deloitte, Ernst & Young, KPMG, and PwC [...]

Construction + Economy, Lighting Industry

California Allocates $3.8 Billion To Transportation Projects

The California Transportation Commission has recently allocated $3.8 billion in funding for various transportation infrastructure improvements across the state. This significant investment aims to enhance bridges, highways, rail systems, and freight corridors throughout California. The majority of this funding, approximately $3.5 billion, comes from the federal Infrastructure Investment and Jobs Act (IIJA), which was [...]

Construction + Economy, Lighting Industry

Gulf & East Coast Port Strike Impacts

The East & Gulf Coasts port strike lasted only three days, but disrupted supply chains for one month across the United States, including major backlogs. The supply chain mess is believed to have been resolved at the end of October, one month after it began. A rise in port worker wages was agreed to, [...]

Construction + Economy, Lighting Industry

Longshoremen Planning East Coast Ports Strike Tuesday

According to Reuters, the International Longshoremen Association have announced a decision by workers to strike at East Coast and Gulf Coast ports, from Maine to Texas. These ports represent about half of all goods imported into the US via ocean shipping. While the majority of lighting industry imports come from Asia through unaffected West Coast [...]

Construction + Economy, Education + Resources

The Economic History Of Light

The other day, I heard a repeat of an old Planet Money radio show episode on NPR about the history of light. Rather than just focus on the changes in technology over thousands of years, it really focused on the economic history of light. The story interviews a Yale economics professor who studied how [...]