Today’s outdoor LED lighting offers a range of utility covering optics, color output, controllability, connectivity, and energy efficiency, writes tED Magazine lighting columnist Craig DiLouie, LC.

Craig’s Lighting Articles

Craig’s Lighting Articles, Interviews + Opinion

Acuity’s Eric Gibson Talks Outdoor Lighting

I recently had the opportunity to interview Eric Gibson, Director, Product Market – Commercial Outdoor, Acuity Brands, for an article I developed for the November 2023 issue of tED Magazine, the official NAED publication. The topic: what’s new in outdoor lighting. DiLouie: According to the Department of Energy in its last SSL forecast in 2019, [...]

Codes + Standards, Craig’s Lighting Articles, Interviews + Opinion

DLC’s Andrew Antares Talks Light Pollution Mitigation

I recently had the opportunity to interview Andrew Antares, Project Manager of Technical Development, DesignLights Consortium (DLC), for an article I developed for the November 2023 issue of Electrical Contractor Magazine, the official NECA publication. The topic: new sample language that municipalities can use to address “light pollution” as a potential byproduct of outdoor lighting.

Craig’s Lighting Articles, Interviews + Opinion, Light + Health

Interview: A New Method for Evaluating Circadian-Effective Lighting

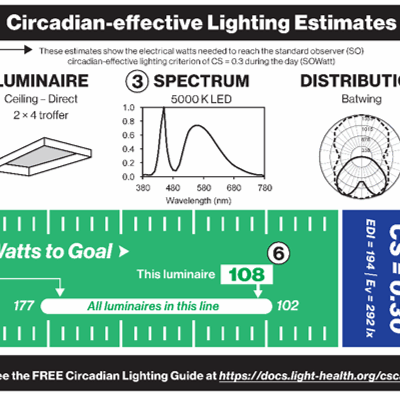

For an upcoming article for Electrical Contractor Magazine, I recently had the opportunity to interview Mariana G. Figueiro, PhD, Director of the Light and Health Research Center (LHRC) and Professor in the Department of Population Health Science and Policy at the Icahn School of Medicine at Mount Sinai, and Professor Mark S. Rea. The topic: a new methodology (called SOWatt), which specifiers could use to evaluate the relative energy efficiency of luminaires in delivering circadian-effective light.

Craig’s Lighting Articles, Interviews + Opinion

Acuity’s Daren Hatfield Talks Field-Replaceable LED Drivers

I recently had the opportunity to interview Daren Hatfield, Director of Marketing – Digital Lighting Components, Acuity Brands for an article I’m developing for the May 2023 issue of tED Magazine, the official NAED publication. The topic: opportunities for distributors serving the LED driver replacement market.

Craig’s Lighting Articles, Interviews + Opinion

BriteSwitch’s Leendert Jan Enthoven Talks Lighting Rebate Trends

For a feature to be published in Electrical Contractor’s April issue, I recently had the opportunity to interview Leendert Jan Enthoven, President, BriteSwitch, a rebate fulfillment firm, whose North American rebate database provided a look at some interesting trends in commercial lighting rebates.

Craig’s Lighting Articles, Legislation + Regulation

Ban The (Fluorescent) Bulb?

In September 2022, California banned the sale and distribution of certain fluorescent lamps over the next few years. In doing so, the state joined Vermont, the European Union, and soon, possibly, Canada and the United Kingdom. Meanwhile, the U.S. Department of Energy is targeting CFLs with new energy standards.

Craig’s Lighting Articles, Lighting Design

Lighting 101: Some Light Reading

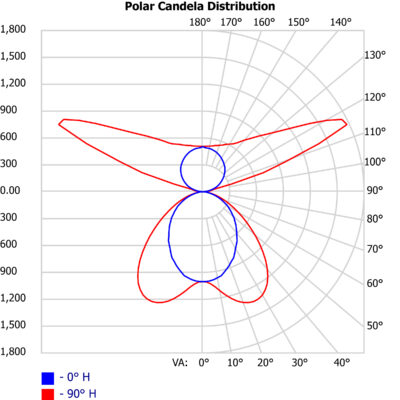

This article describes the photometric report and what electrical distributors can learn from it at a glance, part of a new series at tED Magazine (NAED) that aims to explore lighting fundamentals and attract new distribution professionals to the category.

Craig’s Lighting Articles, Interviews + Opinion

Universal’s Chris Holstein Talks Distributor Opportunity Replacing LED Drivers

I recently had the opportunity to interview Chris Holstein, VP Product Management, Pricing, Marketing for Universal Douglas for an article I’m developing for the May 2023 issue of tED Magazine, the official NAED publication. The topic: opportunities for distributors serving the LED driver replacement market.

Craig’s Lighting Articles, Legislation + Regulation

Tax Incentive Gets New Life

Among its many provisions, the Inflation Reduction Act of 2022 revamped the venerable Commercial Buildings Tax Deduction (CBTD), which incentivizes building owners to invest in energy-efficient interior lighting, HVAC/hot water systems, and/or building envelope.