Industry News

Oregon Launches Its Building Performance Standards Program

The Oregon Department of Energy (ODOE) has launched a new Building Performance Standard (BPS) program aimed at improving energy efficiency in existing large commercial buildings across the state. This…

Emerald Green Venetian Glass Bricks Dazzle

Glen-Gery Corporation, a leading brick manufacturer under Brickworks North America, has introduced Emerald Green as the latest color in its Venetian Glass Brick collection. This launch is positioned to…

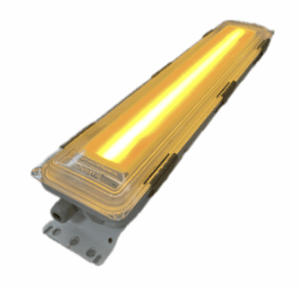

Wildlife-Friendly Lighting Takes To The Seas

Glamox, a leader in marine lighting solutions, has introduced new wildlife and turtle-friendly versions of its popular LED marine luminaires, specifically designed to reduce the negative impact of artificial lighting…

What To Know About RGBIC Lighting

RGBIC lighting represents a more advanced color-changing LED technology, offering enhanced versatility and creative control compared to traditional RGB lighting systems. The term RGBIC stands for Red, Green, Blue, and…

Between Land & Sea: The Seattle Ferry Terminal

Here is my latest article published in the July issue of LD+A Magazine: The Seattle Ferry Terminal at Colman Dock, a crucial hub in Washington State’s ferry system, serves approximately…

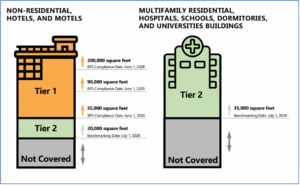

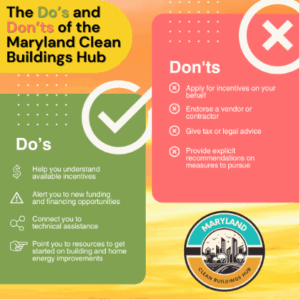

Maryland’s New Building Energy Performance Standards (BEPS)

The Maryland Building Energy Performance Standards (BEPS) are a set of statewide regulations established to reduce greenhouse gas (GHG) emissions and improve energy efficiency in large buildings, as mandated…